Finpay

Digitizing payroll-linked financial services

Empowering Employees with Smarter Financial Access by providing innovative tools.

Trusted By Global Brands:

Finpay Features

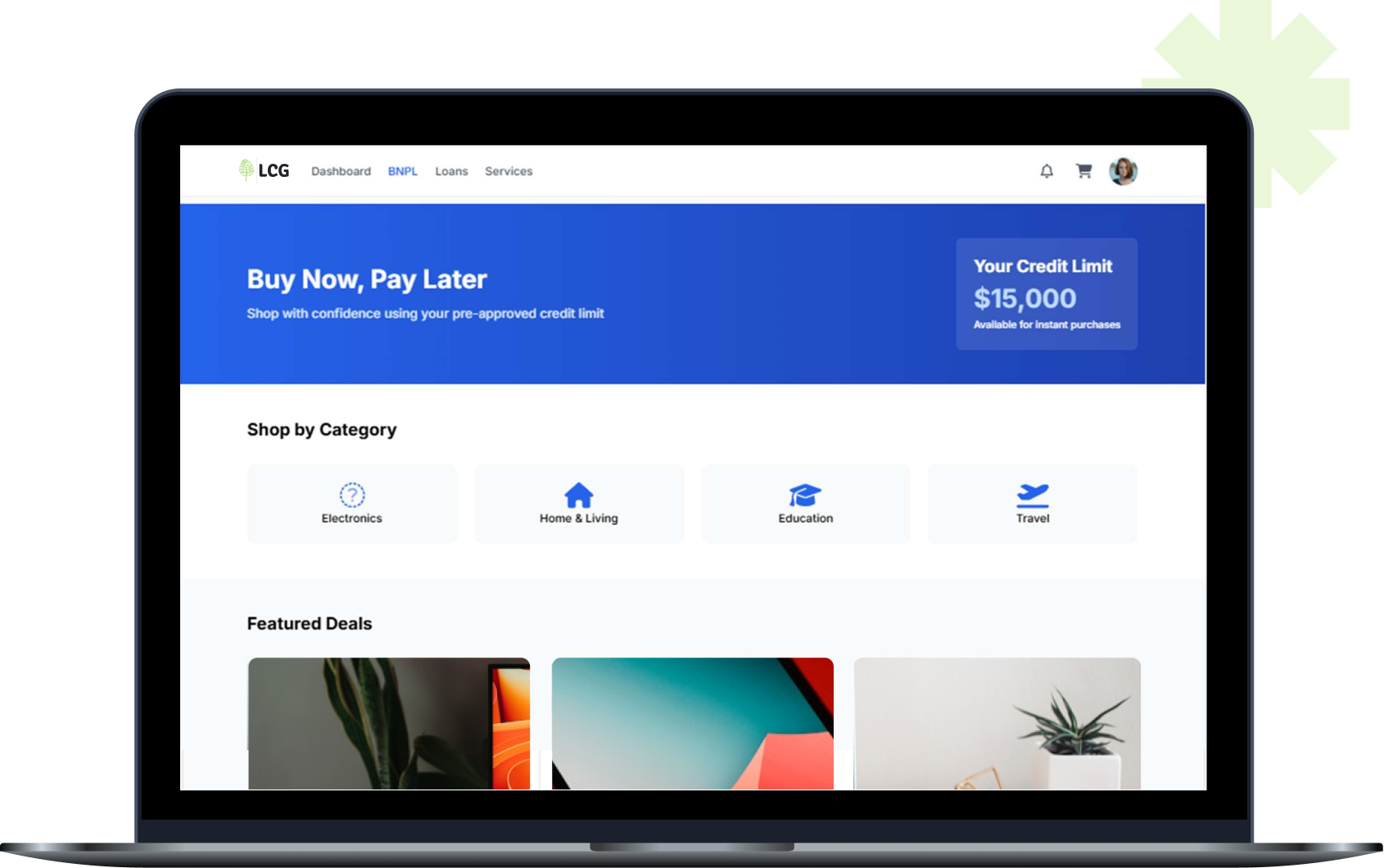

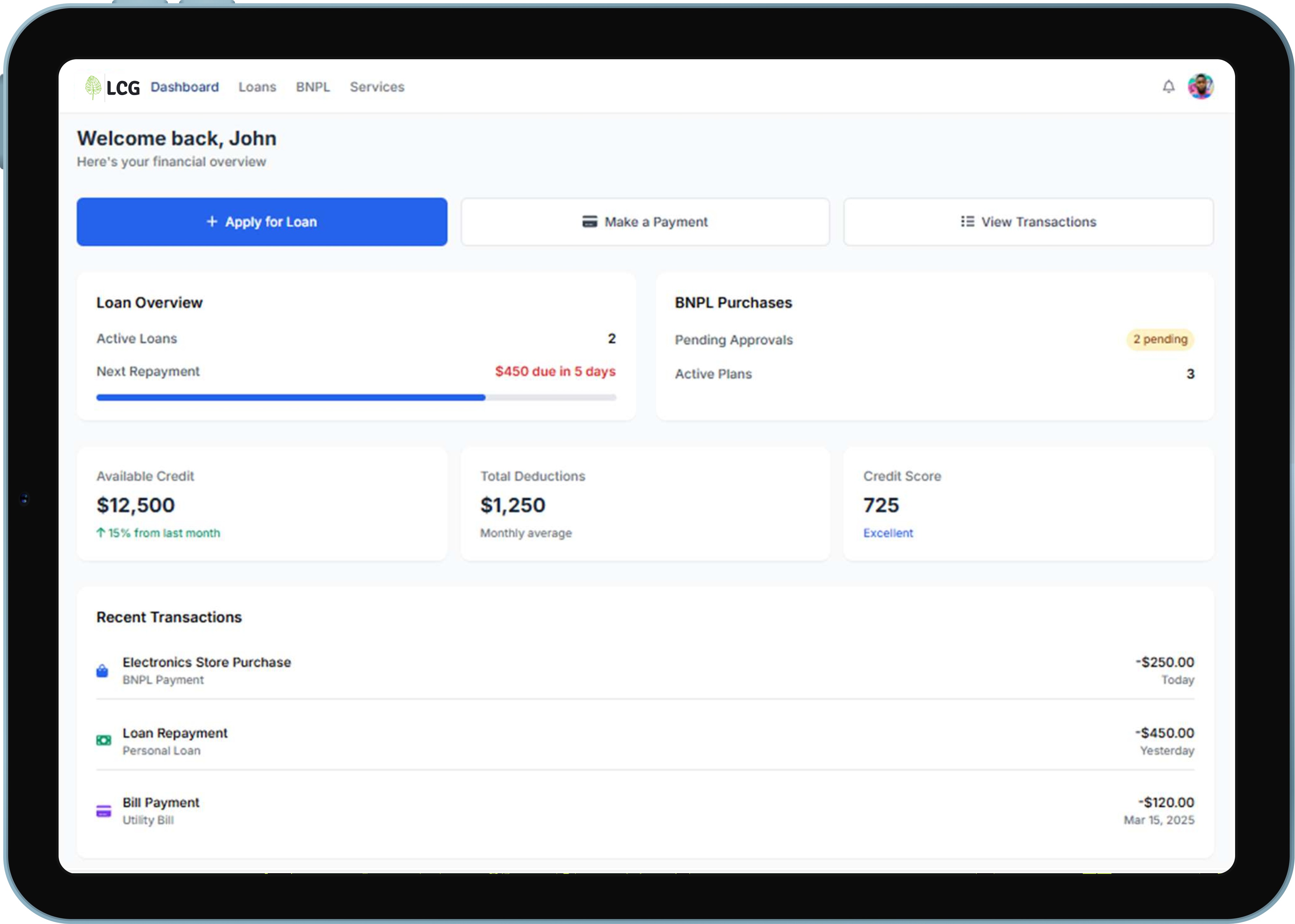

Unified Marketplace for Financial & Lifestyle Products

Our platform is a comprehensive digital marketplace that allows public sector employees to access and purchase a range of essential services—from electronics through Buy Now Pay Later (BNPL) schemes to auto, health, and home insurance.

Employees can browse offers from vetted service providers, select what they need, and pay seamlessly through salary-linked deductions—without upfront cash or credit cards.

Payroll-Integrated Lending & Repayments

At the core of our solution is its direct integration with payroll systems, enabling fully automated deduction processing for all financial transactions made through the platform. Once a product or service is approved, the system schedules structured monthly deductions and adjusts available spending limits in real-time.

This eliminates manual payroll intervention, minimizes repayment defaults, and ensures full transparency for both employees and payroll administrators.

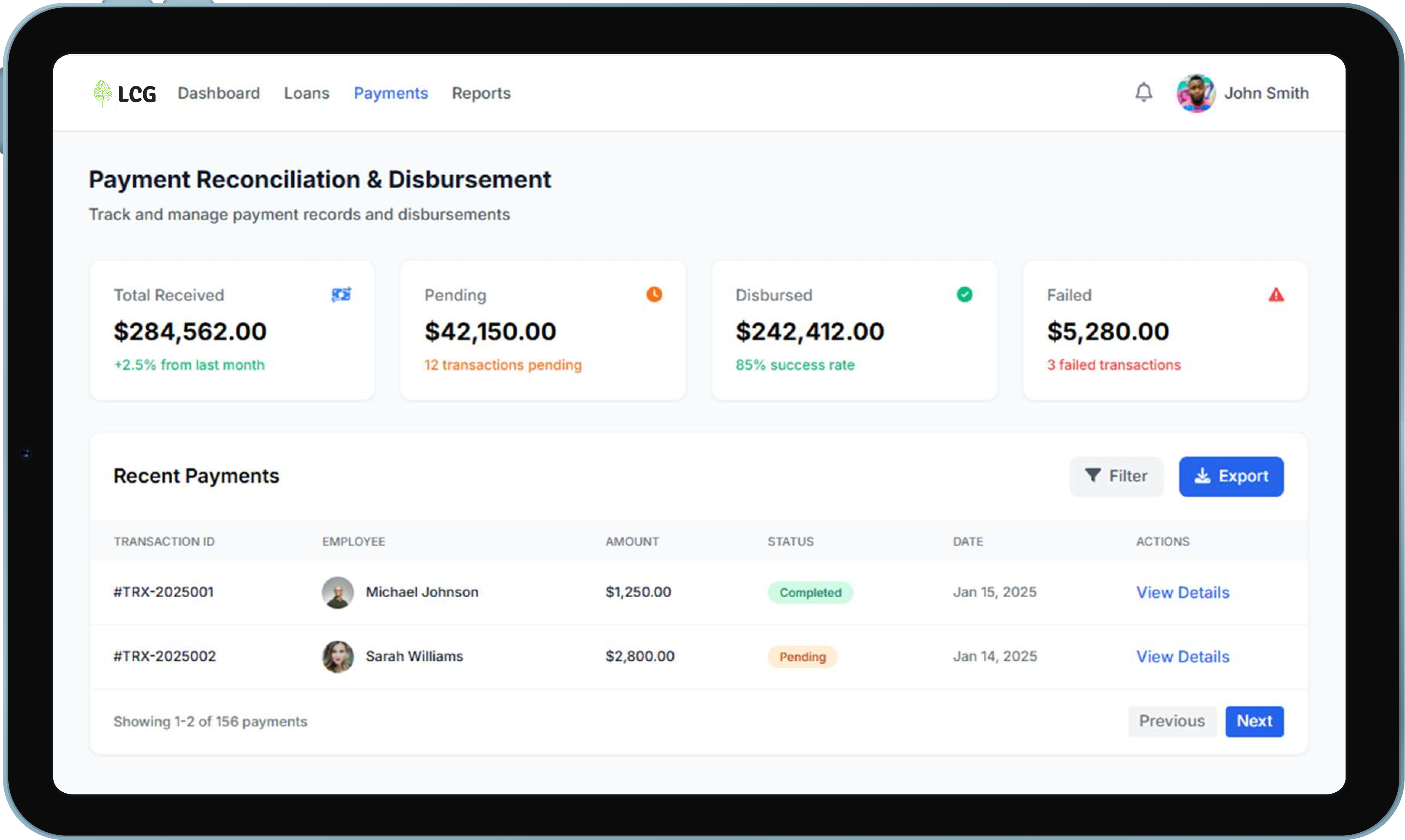

Full Lifecycle Management from Application to Settlement

From onboarding to settlement, our solution manages the entire lifecycle of every financial interaction. Whether it's applying for a loan, scheduling payroll deductions, tracking insurance policies, or reconciling settlements with service providers, the platform ensures smooth workflows, audit trails, and compliance across the board.

Government entities and financial institutions gain a scalable tool to digitize financial services with minimal overhead.

In-App Financial Education & Tools

Provide employees with smart budgeting tools, financial wellness content, and AI-driven insights — all within the payroll platform — to promote better money management.

Embedded Insurance Access

Enable seamless subscription to insurance products (auto, health, home) directly through payroll, giving users affordable coverage without the need for upfront payments.

Automated Risk Assessment

Use employment history, salary data, and payroll behavior to build accurate credit profiles, enabling faster and more responsible underwriting without traditional credit checks.

Our Goal

Intelligent Risk & Credit Assessment with AI Capabilities

Our solution prioritizes responsible finance by using real-time credit score checks and Debt Burden Ratio (DBR) calculations to assess employee eligibility before approving any financial product.

By integrating with national Credit Registry and Financial Clearing Bureaus, the platform ensures only creditworthy employees are approved—safeguarding both the individual and the institution from financial overexposure.